Join ic markets to Encounter the most effective spreads & conditions for buying and selling, plus a stay assistance team that will aid you. It’s Reduced Spreads. The assignment is always to present the smallest possible spreads to dealers under all market requirements. In addition they spent heavily in technology & forged strong relationships with the markets largest & most trustworthy price tag suppliers. They consistently add & tweak our technologies to successfully bring the Most Effective possible requirements for your trader Inside the Market

Speedier Execution

From the NY4 and LD5 info centres in New York and London, Respectively, Ic markets employs enterprise-grade hardware up on our trade servers. In these data centres, the trader servers become collocated with all our pricing suppliers’ data servers. Dedicated fiber-optic cross-connects us pricing providers to be certain the customers have the lowest latency & quickest commerce performance possible.

Superior Technological Innovation

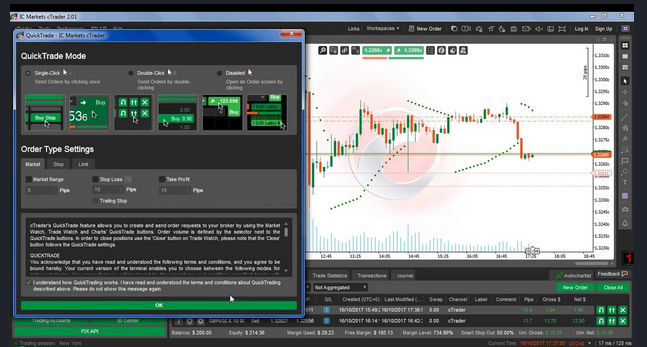

To present you to the Fantastic trading encounter & Cutting-edge trading applications, Ic markets has collaborated with the world’s most excellent trading tech businesses. Such resources include market thickness (DoM), integrated spread monitoring, ladder investing, automatic closing of custom dictate templates transactions, and much more. Our dealing programs for i-phone & Android are supposed to supply you with the very optimal/optimally android dealing expertise possible.

The Best in Buying and Selling Situations

Ic markets get Created for traders. Scalping, hedging & automatic trade are typical permitted. Our spreads to your Raw Spread account get started at 0.0 pips. They have versatile leverage options up to 1:500 accessible, and we take reductions at ten currencies that are significant.

Much better Fills

Customers may be filled in throughout our bridge on commerce scales from 1 Micro piece (1000 base currencies) via 200 lots. The technology sorts & positions prices to enable huge trades to be performed outside at real life over several prices providers and their price ranges, thereby ensuring that the optimal/optimally cost for each size of the trade.